1. Why Is UpRock (UPT) Trending Today?

UpRock is gaining attention due to several intersecting finance, research, and policy factors:

- Increased trading volume: UPT has shown a notable uptick in 24-hour trading, signalling renewed investor and trader interest.

- Device network growth: The number of devices integrated into UpRock’s decentralized network continues to expand, adding credibility to its infrastructure narrative.

- DePIN + AI infrastructure narrative: UpRock combines decentralized physical infrastructure networks with AI-powered data collection, making it relevant in the emerging Web3 infrastructure space.

- Policy and regulatory relevance: As regulators focus on tokenized infrastructure and data networks, UpRock gains visibility and investor attention.

These factors explain why UpRock is trending today.

2. Project Background: What Is UpRock?

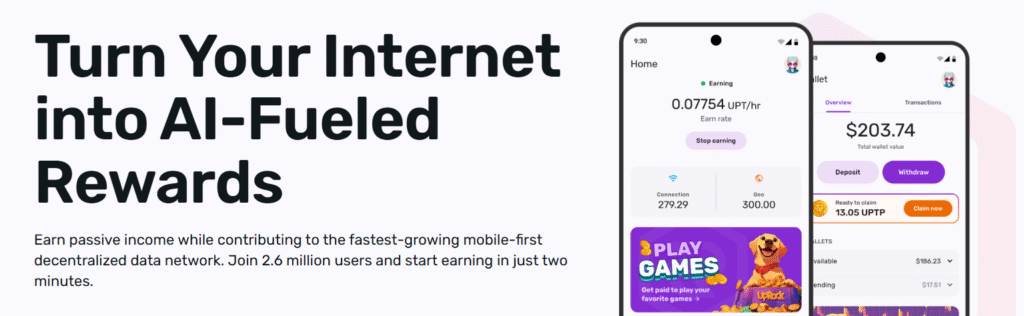

- Launch & Purpose: UpRock is designed to enable users to share unused internet bandwidth while businesses access real-time data and network intelligence.

- Core Technology: The platform uses smart contracts to reward contributors for bandwidth and data contributions, supporting geo-specific data collection and AI training inputs.

- Token Utility: UPT serves as the native token for rewards, staking, and network governance, underpinning the platform’s data economy.

- Market Positioning: UpRock differentiates itself from purely speculative tokens by offering real-world infrastructure utility for AI and bandwidth monetization.

3. Price Trend & Market Metrics

24-Hour & 7-Day Overview

- Current Price: Approximately US $0.0068 per UPT.

- 24-Hour Change: Marginal increase (~+0.2 %).

- 7-Day Performance: Slight decline (~–5.8 %).

- Market Cap & Supply: Circulating supply ~228 million UPT; max supply ~1 billion tokens; market cap around US $1.5 million.

- Exchange Listings: Available on select centralized and decentralized exchanges with active trading pairs.

On-Chain / Technical Patterns

- Network Activity: Device adoption and contribution metrics indicate growing participation.

- Technical Indicators: Price trend shows neutral to weak momentum; RSI suggests potential oversold conditions.

- Tokenomics Note: A large max supply versus current circulating supply means future token unlocks may impact price.

4. What Analysts & the Community Are Saying

- Community Sentiment: Enthusiasm exists around bandwidth sharing and data contribution models.

- Analyst Commentary: Analysts highlight the infrastructure narrative but caution that real-world usage metrics are still early.

- Policy Observations: Regulatory factors concerning data privacy and token reward systems are being closely monitored, affecting growth potential.

5. Growth Opportunities & Risks

Growth Opportunities

- Expanding network utility could drive token demand as real-world tasks increase.

- DePIN and AI integration provide a differentiated niche with potential for adoption.

- Mobile-first accessibility broadens participant base globally.

Key Risks

- Execution risk: The model is early stage; scaling adoption remains critical.

- Supply-side risk: Large max supply and low market cap create vulnerability to dilution.

- Market volatility: Low-cap infrastructure tokens are prone to sharp price swings.

- Regulatory risk: Data collection and token reward mechanisms may face legal scrutiny.

6. Key Takeaway & Opinion

UpRock stands out by combining Web3 infrastructure, AI, and decentralized data networks. Its trading volume and network growth provide foundation beyond speculation.

Opinion: UPT appears fairly valued to slightly undervalued, offering high potential but carrying high risk. It is not over-hyped, but success depends on adoption, network scaling, and regulatory clarity. Investors comfortable with early-stage infrastructure tokens may find opportunity, while risk-averse participants should proceed cautiously.

In summary: UpRock is a promising but speculative DePIN + AI infrastructure play, worth monitoring for adoption and scaling milestones.

Credit: thisishowigetrich.com · November 13, 2025