Introduction

In today’s latest crypto news, META FINANCIAL AI (MEFAI) is trending as investors shift attention to AI-driven tokens with speculative appeal. The surge in social-media mentions, landing in trending token lists, and elevated 24-hour trading volume highlight how MEFAI is capturing interest in the current wave of crypto trends today. As part of the broader blockchain market update, MEFAI stands out among low-cap AI/utility tokens.

Overview

Project Background

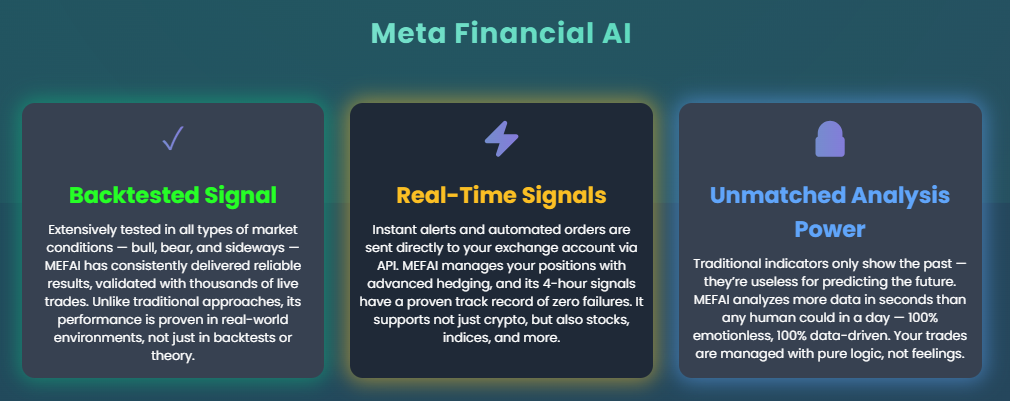

- META FINANCIAL AI (ticker: MEFAI) is an AI-powered cryptocurrency project launched on the BNB Chain, designed to integrate predictive analytics and token utility.

- The core technology is described as a proprietary AI trading ecosystem that blends predictive modules, risk-management features and token-based access to data-driven workflows.

- The purpose: position MEFAI as a utility token supporting AI-enabled decision-making, crypto analytics and financial tools—leveraging the narrative of “AI meets blockchain”.

Market Performance

24-Hour & 7-Day Trends

- In the most recent 24 hours, MEFAI’s price has dipped by approx. -2% to -3% amid elevated trading volume, signalling mixed sentiment despite trending status.

- Over the past 7 days, the token has shown greater volatility, with price movement reflecting both speculative inflows and pull-backs as the market assesses its prospects.

Volume, Market Cap & Listings

- 24-Hour Trading Volume: Up significantly compared to prior period, indicating increased market focus.

- Market Cap Estimate: Circulating supply is roughly 620 million tokens, with a market cap in the low millions USD—marking MEFAI as a very small-cap token.

- Exchange Listings: MEFAI is tradable on various decentralized exchanges (DEX) and some centralized listings; accessibility is moderate but liquidity remains thin compared to major assets.

On-Chain or Technical Insights

- On-chain activity shows rising wallet transfers and token swap events – possibly reflecting early speculative momentum rather than established utility usage.

- Technical analysis: MEFAI recently broke above a prior consolidation band but also faces potential resistance, given its small-cap nature and high supply. Price swings remain large and short-term patterns carry higher risk.

- Tokenomics: With a maximum supply of 1 billion tokens and a relatively high circulating supply, MEFAI’s structural scarcity is modest—making demand growth more critical than supply tightness.

Expert & Community Sentiment

- Analyst commentary: MEFAI is often characterised as a speculative token within the “AI-blockchain” niche—interesting for momentum players but lacking deep independent coverage or verified adoption so far.

- Community sentiment:

- Optimistic: Some participants view MEFAI as an early-stage play in the growing AI token space, drawn by low entry price and high upside potential.

- Cautious: Others warn that the token has limited transparency on utility milestones, low liquidity, and high exposure to hype cycles.

- Social-media observation: The token appears in trending lists and meme-token threads, indicating awareness is rising—but committed institutional endorsement is minimal at this stage.

Future Outlook

Growth Opportunities

- If MEFAI can deliver on its roadmap—such as launching AI analytics services, forming partnerships or gaining token integration—its narrative could shift from speculative to utility-driven.

- Listing on higher-tier exchanges and improved liquidity would enhance visibility, thereby possibly attracting broader investor participation.

- As the AI-crypto thematic strengthens, MEFAI may benefit from sector rotation favoring tokenised AI infrastructure and analytics.

Risks & Challenges

- Being a very small-cap token, MEFAI is exposed to high volatility, low liquidity and risk of sharp downturns if sentiment wanes.

- Implementation risk is significant: Without tangible adoption, the token may struggle to justify elevated interest or price levels.

- The AI-token niche is becoming crowded—differentiation will matter, and MEFAI must convincingly deliver value beyond narrative.

- Market and regulatory risk: Small tokens often carry increased regulatory scrutiny, and token performance may be impacted by broader macro crypto conditions.

Conclusion

META FINANCIAL AI (MEFAI) is a high-risk, high-potential token operating at the intersection of AI and crypto. From a [META FINANCIAL AI] analysis perspective, the token appears undervalued if its platform executes and adoption grows meaningfully. However, given its very early stage, limited liquidity and speculative nature, the current valuation is more accurately described as fairly priced for what it offers today: a speculative entry in the “AI meets blockchain” category. For investors and enthusiasts monitoring crypto trends today and the evolving blockchain market update, MEFAI merits attention—but with caution and a clear understanding of its elevated risk profile.

Credit: thisishowigetrich.com

Date: November 4, 2025